An African Safari is the trip of a lifetime..

…and insuring your trip with Travel Insurance is a very important component of your trip. Travel Insurance has many functions in protecting you before and during your African Safari. It protects you in the event of accidents or illness while traveling. It can cover you if you participate in adventure sports on your trip (hot-air balloon rides, zip-lining, etc.). It can even cover any expensive equipment (cameras, video gear, etc.) that you might bring on your safari.

But Travel Insurance does much more than that. What if you become ill and have to cancel your African Safari? Your Travel Insurance covers that. What if you have a family member who is not going on the trip with you, but becomes ill and their illness requires you to cancel your trip? Your Travel Insurance can cover that as well. Without Travel Insurance, if the unforeseen happens and you have to change your Safari plans, you could end up losing all of the money you paid for your trip of a lifetime. This is why Travel Insurance is SO important when going on an African Safari. But you have to make sure you purchase the right insurance policy the right way, otherwise your Travel Insurance policy could end up being worthless to you. So let’s dive in…

Requirements for Purchasing Travel Insurance for Your Safari

First, there are only three basic requirements you must meet in order to purchase Travel Insurance for Your Safari:

- You must be a resident of The United States

- Your African Safari trip must start and end in The United States

- You must be medically able to make the trip on the day you purchase the insurance. (ie., You can not have a broken leg or be otherwise incapacitated in some way on the day you purchase your Travel Insurance policy.)

As long as you meet these 3 requirements, read on…

The most important part of your Travel Insurance Policy:

The Waiver for Pre-Existing Medical Conditions

Regardless of which Travel Insurance policy you choose, having the waiver for pre-existing medical conditions is the most important part of your policy. Even though you may be in perfect health when you purchase your Travel Insurance policy, suppose you have a family member (see the definition of “Family Members” below) who becomes ill, and this illness requires you to cancel your safari. If you have the waiver for pre-existing medical conditions on your Travel Insurance policy, you are covered regardless of whether or not the illness was due to a pre-existing medical condition. However, without the waiver, if you have to cancel your trip due to a family member’s illness, in order to have your loss covered by the insurance, you would need to submit medical records to the insurance company to prove that the illness was NOT due to a pre-existing medical condition. And if the illness WAS traceable to a pre-existing medical condition (or if you can not prove that it was not), then your Travel Insurance policy will be worthless.

So without the waiver, if you have to cancel your trip due to the illness of a family member, at best you will have a long difficult fight ahead of you with the insurance company to get your loss covered, and at worst, you could be completely exposed to the loss of what you paid for your trip.

Bottom line: BE SURE your Travel Insurance policy contains the waiver for pre-existing medical conditions to be completely covered in the event of a loss.

How to Get the Waiver for Pre-Existing Medical Conditions added to Your Travel Insurance Policy

Fortunately, this is very easy to do! All you need to do to get the waiver for pre-existing medical conditions added to your policy is to purchase your Travel Insurance policy within 14 days after making your first payment for your safari, whether that payment is for the safari itself or the air travel. All of the Travel Insurance policies that we recommend function this way. There is nothing else you need to do, the waiver will be automatically added to your policy as long as you purchase your Travel Insurance policy within the 14 day time frame. Unfortunately though, this is the ONLY way to obtain the waiver for pre-existing medical conditions. If more than the allotted time has passed since you made your first payment for your trip and you still have not purchased your Travel Insurance policy, there is no other way to add the waiver.

Bottom line: MAKE SURE you purchase your Travel Insurance policy within 14 days after making your first payment for your safari (either for the safari itself or air travel), and the waiver for pre-existing medical conditions will be automatically added to your policy, and you will then be fully covered!

How the Insurance Company Defines a “Family Member”

For the purposes of insuring an African safari, this is what the insurance company considers a “family member”:

| These Relations ARE Considered Family Members | These Relations ARE NOT Considered Family Members |

|---|---|

|

|

If any person considered a “Family Member”, whether they are traveling with you on your safari or not, becomes ill and you need to cancel your safari as a result of the illness, your Travel Insurance policy would cover the loss (just make sure you have the “Waiver for Pre-Existing Medical Conditions” described above).

The “Name a Family Member” Option

Some insurance plans that we recommend have the option to Name a Family Member. This option allows you to add 1 (one) additional person who is NOT considered a Family Member (as defined above) to be added to your Travel Insurance policy as if they WERE a family member.

Example: Suppose you had an elderly neighbor who was not related to you, that you looked after. You might considering adding them as a “Name a Family Member”. If they became ill and needed your care when it was time for your safari, and you needed to cancel your trip because of this, if they had been named on your policy as a Named Family Member, you would be covered, even though they are not related to you. If they were not named as a family member on your policy, you would not be covered in this instance.

Bottom line: For most people, this is not necessary, but it IS an option on certain Travel Insurance plans, should you need it.

The Travel Insurance Policies That We Offer

We recommend Travel Insurance from AIG/Travel Guard for African Safaris. There are three general travel insurance policies that work well for insuring your Safari. Below is a brief description of each policy so you can decide which one is best suited to your needs.

The Travel Guard Plus Plan

By Travel Guard

This plan offers top-of-the-line, comprehensive coverage. As such, it is normally one of AIG/Travel Guard’s most expensive plans; however, when purchased for travel to lower Africa (Safari Countries), it is actually very reasonably priced (here’s why), and thus can be the plan with the best “Bang for the Buck”. The plan offers $100,000 of medical coverage per person, and $1,000,000 of coverage for emergency evacuation, which are very important for African Safaris. It covers evacuation to a hospital of your choice, which is normally your hometown hospital, but can also be a hospital that specializes in an injury that you have suffered. It also covers adventure sports (hot air balloon rides, zip-lining, white-water rafting, etc.). Additionally, the Travel Guard Plus Plan offers an additional 6 days after the date of your first safari payment (over the usual 14 days) to purchase your Travel Insurance to still get the waiver for pre-existing medical conditions. The only disadvantage to this plan is that it does not offer a “Name a Family Member” option.

Our Recommendation: If you want a comprehensive plan with all the bells and whistles without the need to add extra options, and you don’t need the “Name a Family Member” option, this is the plan for you. Although check the price of the Preferred plan (when you Get A Quote) as it might be less expensive in your situation.

PROs

- Offers outstanding comprehensive coverage for a very reasonably priced plan for African safaris

- Includes adventure sports

- Best “Bang for the Buck”

- Offers 20 days after initial safari payment (instead of the usual 14 days) to automatically receive the waiver for pre-existing medical conditions

CONs

- Does not include the “Name a Family Member” option.

The Preferred Plan

By Travel Guard

The Preferred Plan is typically less expensive than the Travel Guard Plus Plan and offers $50,000 in medical coverage and $500,000 of coverage for emergency evacuation (half of the coverage of the Travel Guard Plus Plan). It does not include adventure sports but that can be added as an option. If you opt for this plan we definitely recommend upgrading the medical coverage and emergency evacuation (called the “Medical Bundle”) to $100,000 and $1,000,000 respectively (this gets you evacuation to your hospital of choice), and adding the adventure sports option. (It’s cheap, and if a hot-air balloon ride opportunity presents itself, you’ll want to be covered!) This plan also includes the “Name a Family Member” option. After adding the recommend coverage options, The Preferred Plan is roughly comparable in price to the Travel Guard Plus Plan. Depending on factors such as the state you are originating from, your age, etc., it’s possible that The Preferred Plan with the recommended options added might be less expensive than the comparable Travel Guard Plus Plan.

Our Recommendation: If you are price conscious and want to get the best deal possible, we recommend pricing this plan with the upgraded medical and emergency evacuation coverages (the “Medical Bundle”) as well as the adventure sports option, and then price the Travel Guard Plus Plan and pick the one that ends up being less expensive for your particular situation. However if you need the “Name a Family Member” option, you definitely want The Preferred Plan with the upgraded coverages.

PROs

- Customizable with many options

- Offers the “Name a Family Member” option

- Could be slightly less expensive than the comparable Travel Guard Plus Plan depending on certain factors

CONs

- Offers less coverage in its base form than the Travel Guard Plus Plan.

The Deluxe Plan

By Travel Guard

This plan is AIG/Travel Guard’s most comprehensive plan, and is priced accordingly. As far as medical and emergency evacuation coverage, it is comparable to the Travel Guard Plus Plan but is usually more expensive. This plan is almost never the best choice, however the advantages of this plan is that it does offer better coverage for personal equipment (ie, expensive cameras), and it does offer the “Name a Family Member” option.

Our Recommendation: The only reason to opt for this plan would be if you had some expensive equipment that you need to insure on your safari, and you need the “Name a Family Member” option.

PROs

- Top of the line coverage

- Good coverage for personal equipment

- Offers the “Name a Family Member” option

CONs

- Usually the most expensive of the three plans

- Not as good a value as the other two plans

We Encourage Comparisons of Coverages and Prices with Plans from Other Travel Insurance Companies

To get started click the AIG – Get a Quote button. You will be taken to the AIG Travel Guard website. We will never see your confidential information. After entering your trip information, you see the prices of the Preferred, Deluxe, and Travel Guard Plus plans (see screenshot). You can add options to each plan by clicking the arrow under “Optional Bundles” on each plan. You can stop at this point and do comparisons of prices and coverages of plans with other travel insurance companies, or you can make a decision as to which plan to buy, and continue with that plan until the policy is purchased. You’ll find it’s very easy to compare plans and prices to see which plan is right for you.

If you do decide to continue on, you will first be asked for your mode of transportation. If you know which airline you will be traveling on, click on the airline button and select the airline. If you click on the tour operator button, you almost certainly will not find your tour operator. If so, just unclick the tour operator button. You can always click on None of the above.

What To Do After You Purchase Your Policy

After you purchase your policy, you will receive a confirmation email from Travel Guard containing your policy number. Copy your policy number to your clipboard. Then click on the word “here” at the end of the first line below your policy number.

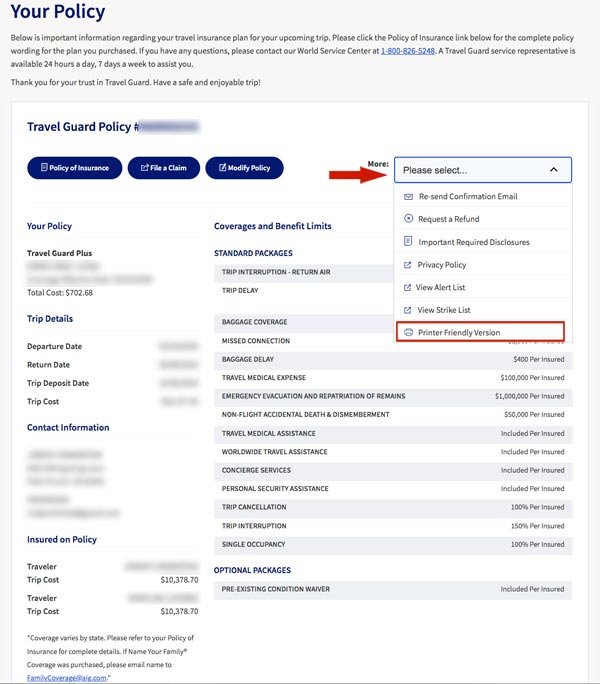

You will then see a login screen asking for your policy number and last name. Paste your number, enter your last name, and click Continue. You will then see your policy (see screenshot). If you qualified for the Pre-existing Condition Waiver, you will see that on the lower left, under Optional Packages.

At the top right hand corner, you will see a box labelled More: Click on the drop-down box and click on the last option “Printer Friendly Version”. You will see your policy again, except that now when you scroll down you will see an Identification Card for each traveler. Keep these cards with you throughout your trip.

We also strongly recommend that you print out multiple copies of these Identification Cards, and use them as baggage tags. Just cut away all the personal information, just below the ID #, which is your Policy Number.

If an airline loses your luggage, this will greatly simplify the process of getting them back.

All the ID cards have the international number to call if anything goes wrong on your trip, whether it is a covered item or not. Lost or delayed luggage are covered items. However, if you lose your passport or forgot your medication, which are not covered items, you still need to call Travel Guard. They will help you resolve the problems at no charge. Travel Guard is famous for this added service.